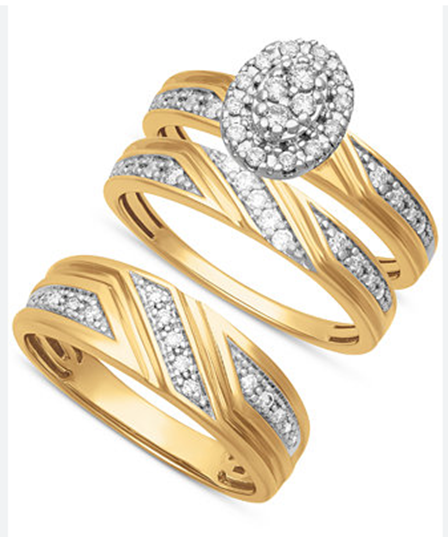

Jewelry isn’t just valuable — it’s personal.

Whether it’s a wedding ring, heirloom necklace, or designer watch, these items often exceed the protection limits of a standard homeowners’ policy. That’s why this is so important.

A Personal Articles Policy (PAP) is a standalone policy specifically designed for your valuables, including jewelry, watches, collectibles, and other personal items

Why do many people choose this? What are the Key Advantages? Find out here!

What are the Key Advantages of a Personal Articles Policy(PAP)?

- Coverage is separate from your home policy, so jewelry claims typically don’t touch your homeowners record.

- Most PAPs include all-risk protection, including accidental loss and damage.

- You can often choose an agreed value with no deductible (depending on the carrier).

What is the difference between scheduled personal property and a PAP?

1. Broader coverage (“open perils”)

- Covers almost all causes of loss, including accidental damage and mysterious disappearance

- Homeowners’ schedules may still exclude certain losses or don’t fully remove exclusions like accidental damage

2. No deductible

- Most PAPs pay from the first dollar

- Scheduled items on homeowners usually follow the homeowner’s deductible

3. Higher and guaranteed limits

- Each item is insured for its appraised or agreed value

- No reliance on the overall homeowners’ personal property limits

4. Worldwide coverage

- Covered anywhere in the world, automatically

- Homeowners coverage can be limited or restricted abroad

5. Better claims handling

- Often handled by specialty adjusters familiar with jewelry, fine art, collectibles, etc.

- Less risk of disputes over depreciation or valuation

6. Doesn’t impact homeowners’ loss history

- Claims typically don’t surcharge or affect homeowners’ renewals

When a PAP Is Usually the Better Choice

- Jewelry, watches, engagement rings

- Fine art, collectibles, memorabilia

- Musical instruments

- High-value or frequently worn items

- If you are concerned about homeowners claims history

Simple Rule of Thumb

- Low-value, rarely used items → Scheduling with homeowners may be fine

- High-value, wearable, sentimental, or frequently traveled items → Personal Articles Policy is superior

- Remember to get items appraised — carriers typically require recent appraisals (5 years or newer) or receipts.

We are here to help. Click to get a quote!